Valuations and momentum in 2024

.avif)

Data from the first few months of 2024 presents a market that is still finding its footing -- there are some indications of normalization in early-stage financings, while an inflection point for late stage still appears further away.

The prevailing narrative since the end of 2021 has been one of stress feeding through venture markets owing to a combination of a higher rates environment, banking market volatility, and subdued IPO markets. Median post-money valuations fell ~50% from 2022 to 2023. These developments were accompanied by steady increases in the prevalence of down rounds through last year, as noted in the Aumni Venture Beacon Year End 2023 Report.

Where do we stand now in 2024?

At the macro level, the picture in 2024 remains mixed. Supporting a more constructive view, one can point at market commentary generally more centered on rate cuts than hikes. Meanwhile, the Nasdaq is sitting close to 2021 highs following a period of strong performance, and a growing number of companies are achieving IPOs with strong post-listing performance.

Supporting a more cautious perspective, there may be a meaningful number of companies that last raised in a ZIRP-era paradigm that are yet to raise a follow-on round and whose historic valuations may not yet be fully supported by current revenue and growth. At the same time, market expectations for rate cut timings have moved out in recent weeks following more hawkish Fed commentary.

Valuations

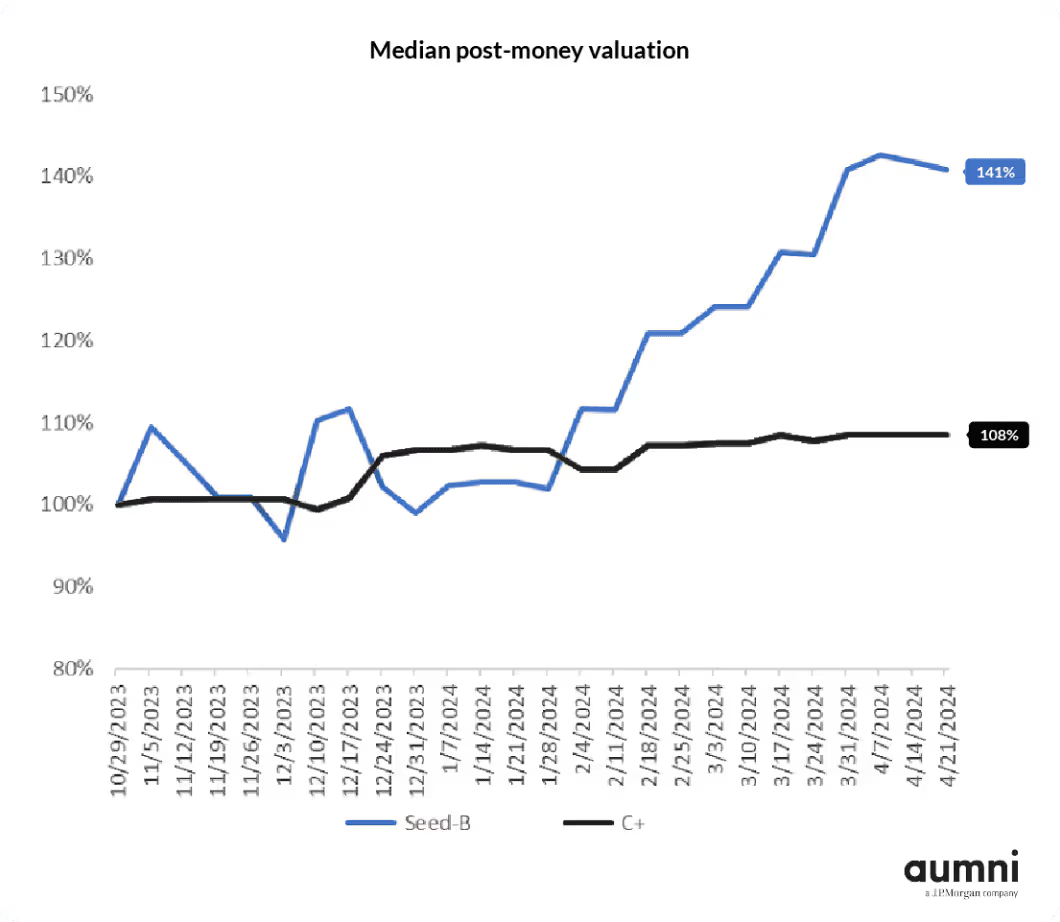

While valuations are nowhere near the levels seen in 2021, data does indicate some recent improvement from last year, but with a bifurcation of performance by stage.

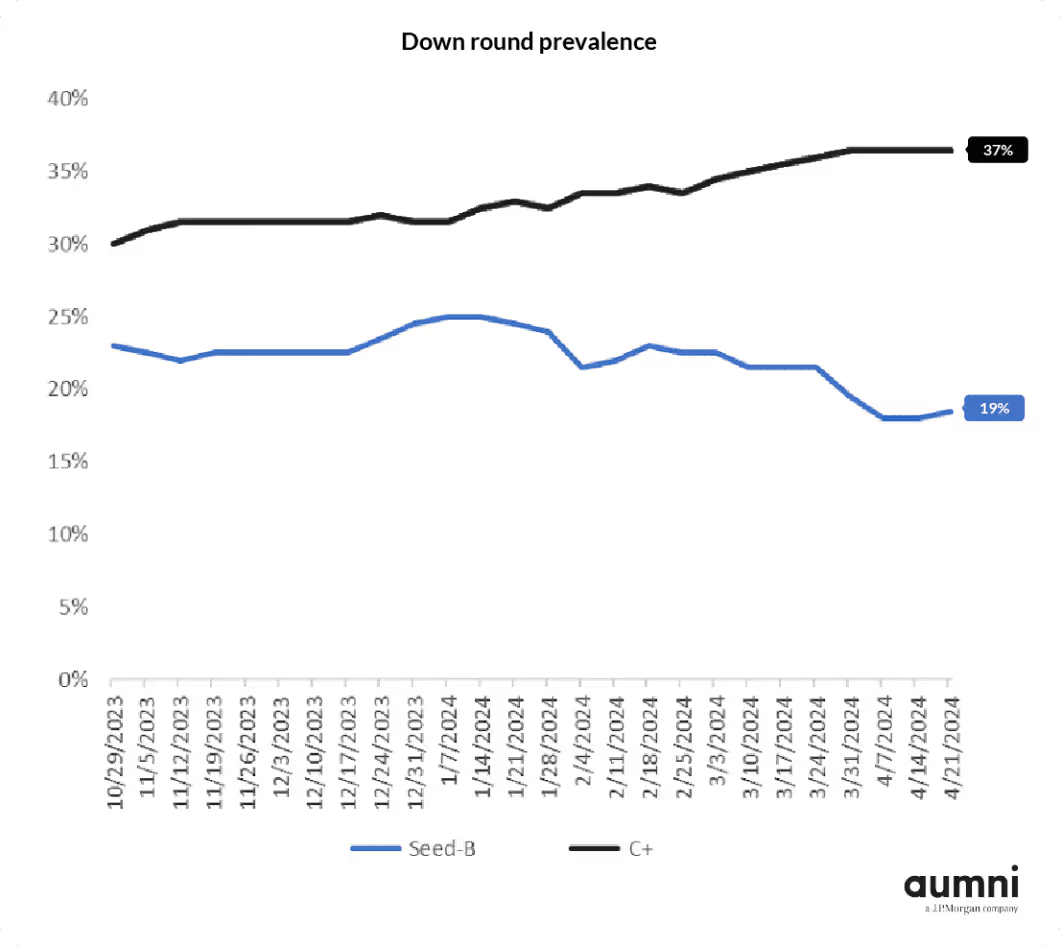

Early-stage companies have seen median post-money valuations increase ~40% in the last 6 months, and even late-stage companies have seen ~10% improvement in PMVs over the same period. In addition, early-stage companies have started to see some reduction in the prevalence of down rounds – however the up-trend has yet to be broken in late-stage financings, where ~37% of companies are experiencing a down round, according to recent data from Aumni-tracked venture deals.

Momentum

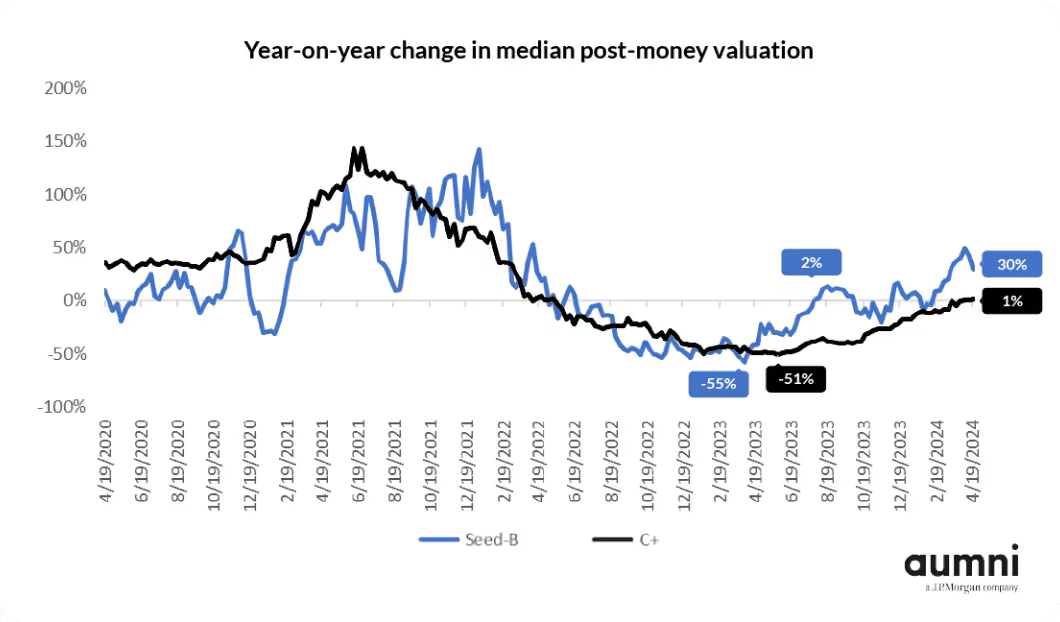

Using YoY change in median post-money valuation as a proxy for momentum, we can also see that both early- and late-stage companies were experiencing maximum (50%+) YoY declines in PMV in 2Q23. Following the rapid decline, early-stage companies stabilized relatively quickly and then saw improving trends. However, late-stage companies have seen a slower recovery in valuation trends, only returning to flat YoY change in PMV in April.

Aumni will continue to monitor these trends and other market developments.

Photo by Edryc James P. Binoya on Unsplash

©2025 JPMorgan Chase & Co. All rights reserved. JPMorgan Chase Bank, N.A. Member FDIC.

This material is not the product of J.P. Morgan’s Research Department. It is not a research report and is not intended as such. This material is provided for informational purposes only and is subject to change without notice. It is not intended as research, a recommendation, advice, offer or solicitation to buy or sell any financial product or service, or to be used in any way for evaluating the merits of participating in any transaction. Please consult your own advisors regarding legal, tax, accounting or any other aspects including suitability implications, for your particular circumstances or transactions. J.P. Morgan and its third-party suppliers disclaim any responsibility or liability whatsoever for the quality, fitness for a particular purpose, non-infringement, accuracy, currency or completeness of the information herein, and for any reliance on, or use of this material in any way. Any information or analysis in this material purporting to convey, summarize, or otherwise rely on data may be based on a sample or normalized set thereof. This material is provided on a confidential basis and may not be reproduced, redistributed or transmitted, in whole or in part, without the prior written consent of J.P. Morgan. Any unauthorized use is strictly prohibited. Any product names, company names and logos mentioned or included herein are trademarks or registered trademarks of their respective owners.

Aumni, Inc. (“Aumni”) is a wholly-owned subsidiary of JPMorgan Chase & Co. Access to the Aumni platform is subject to execution of an applicable platform agreement and order form and access will be granted by J.P. Morgan in its sole discretion. J.P. Morgan is the global brand name for JPMorgan Chase & Co. and its subsidiaries and affiliates worldwide. Aumni does not provide any accounting, regulatory, tax, insurance, investment, or legal advice. The recipient of any information provided by Aumni must make an independent assessment of any legal, credit, tax, insurance, regulatory and accounting issues with its own professional advisors in the context of its particular circumstances. Aumni is neither a broker-dealer nor a member of any exchanges or self-regulatory organizations.

383 Madison Ave, New York, NY 10017