5 Ways CFOs and Finance Teams Can Benefit from Data Driven Decision-Making

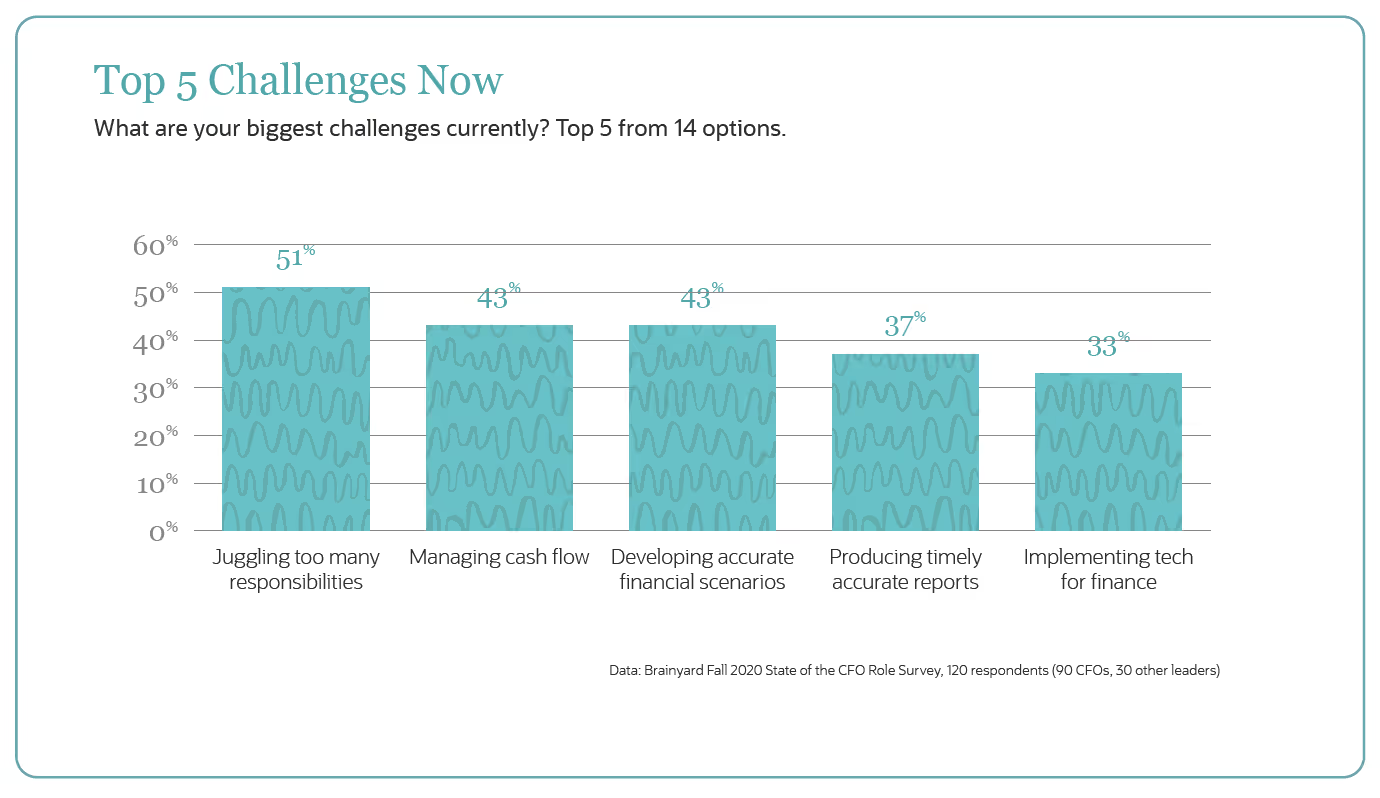

In general, there is a real need to give overworked CFOs a way to quickly access reliable data. According to Netsuite’s Fall 2020 State of the CFO Role Survey, in general, CFOs reported their main concern with their job is juggling too many responsibilities, followed by managing cash flow, developing accurate financial scenarios, and producing timely and accurate reports.

These struggles are consistent with what we’ve seen across our venture CFO clients. Fortunately, where there are challenges there are also opportunities. In the year ahead, CFOs are looking to put investment dollars into technologies that can positively affect their company in many ways. According to CFO Leadership Council President, Jack McCullough, who recently shared his insights into CFO priorities for 2021, artificial intelligence, machine learning and data analytics tools can be transformative as CFOs are asked to make better decisions faster.

McCullough also noted that CFO optimism is on the rise and that they are preparing for explosive growth in 2022. Finance chiefs will be integral to the growth journey for their organizations and they will need a strong data strategy to support them.

Aumni’s data-driven approach enables venture capital CFOs to add new efficiencies to their process. Here are five examples of how finance teams can benefit from implementing our technology into their workflow:

● Automate LP reporting - The relationship between venture CFOs and their limited partners (LPs) is constantly evolving. One dynamic of this relationship is how to best achieve financial transparency for tracking details of the fund’s transactions while creating a uniform reporting structure across a portfolio with SEC Registration expectations in mind. In the current economic environment, LPs are demanding accountability, which means a bigger push for better processes and analytics. There have even been discussions in the LP community about the benefits of adopting a standard reporting structure. Aumni allows venture CFOs to be ahead of the curve in meeting their LP obligations. Rather than having to manually track down each document for each deal to identify details, such as who owns what, when changes occurred, etc., CFOs can access Aumni and instantly pull data points across the entire portfolio or a subset of funds in order to provide reporting information to their LPs. This can save a great deal of time when it matters most.

● Streamline valuations - When it comes to performing valuations, speed and accuracy are key. Turning on a dime can be challenging for CFOs and their teams, especially when tracking down information that requires digging into multiple documents related to a single deal. Having one central repository can be a game changer in these situations. Aumni’s automated approach delivers incredible efficiencies for finance teams with regards to both data accuracy and reliability, according to Kim Mueller, Director of Customer Success at Aumni and former CFO of Pelion Ventures. She says: “Deals happen fast, so the information [being accessed by a fund CFO] needs to be accurate and up-to-date. If not, then this can lead to discrepancies between the exact terms in the final agreement and what was discussed. During the contract signature phase, each party (the general partners, the finance team, outside counsel, the portco) believes the other party has reviewed the agreement carefully to reflect the latest and greatest. It's an unfortunate ‘diffusion of responsibility’ that ends up causing many fire drills later on.”

● Augment partner meeting preparations - Whenever the finance team is tasked with preparing the investment professionals for various meetings, a centralized data hub is invaluable for them as well. When there are many portfolio companies in the mix, it’s not feasible for a human unsupported by technology to recall all the specific details for every single portfolio company. The finance team may be asked to provide information on a given portfolio prior to a board meeting, an important negotiation, or discussion. They may be thinking through liquidation or fundraising scenarios or trying to evaluate: "Who has the vote? Do we have power to make this happen? Who are the people that have a veto right?" What may have taken the finance team days or weeks to answer by making requests from law firms or portfolio companies, with Aumni they can gauge in just a few clicks.

● Simplify annual audits - Annual audits are often painful for CFOs and their teams, who are integrally involved in the process of collecting deal documents and answering auditors' questions. Enabling auditors to access relevant data seamlessly can significantly expedite the process for the finance department. With Aumni, we have calculated that our automated solutions reduce audit workload by more than 50 percent. With our audit prep solution, clients gain expert help in hunting down missing deal docs; Aumni then provides an exhaustive document review process for completeness and accuracy; and, ultimately, we produce on-demand access to fund data.

● Identify critical deal errors sooner - Whether it’s the transposition of a number, substantive typos, or missing paperwork, mistakes in documents happen more than we realize. When reviews are performed solely by humans, errors can go unnoticed; however, that is also true when reviews are performed solely by computers. As Aumni’s VP Customer Success and Strategy, Katrin Robb, shared with us in a recent interview, an automated process catches different types of discrepancies than the human eye. Aumni’s hybrid A.I. and human review method identifies unexpected errors in source documents (even when data points are in different documents), which leads to more accurate and consistent information for finance teams when they are working through any of the above tasks and objectives. It’s a truly innovative and scalable way to ease the burden on financial teams.

The year ahead looks to be a transformative one as venture finance teams strive to create profitable, flexible and competitive organizations by harnessing the power of their business data. Automation is key in balancing the document and data management associated with multiple deals and portfolios. An analytics platform such as Aumni empowers CFOs looking to promote operational efficiency, craft their data strategy and create a positive return on their technology investment. In the words of our client, Ingrid Chiavacci, CFO at Hummer Winblad: "For those of you VC CFOs who need an accurate and reliable system to keep track of all your investments, and are tired of sifting through dozens of Excel files, you should definitely check out Aumni."

©2025 JPMorgan Chase & Co. All rights reserved. JPMorgan Chase Bank, N.A. Member FDIC.

This material is not the product of J.P. Morgan’s Research Department. It is not a research report and is not intended as such. This material is provided for informational purposes only and is subject to change without notice. It is not intended as research, a recommendation, advice, offer or solicitation to buy or sell any financial product or service, or to be used in any way for evaluating the merits of participating in any transaction. Please consult your own advisors regarding legal, tax, accounting or any other aspects including suitability implications, for your particular circumstances or transactions. J.P. Morgan and its third-party suppliers disclaim any responsibility or liability whatsoever for the quality, fitness for a particular purpose, non-infringement, accuracy, currency or completeness of the information herein, and for any reliance on, or use of this material in any way. Any information or analysis in this material purporting to convey, summarize, or otherwise rely on data may be based on a sample or normalized set thereof. This material is provided on a confidential basis and may not be reproduced, redistributed or transmitted, in whole or in part, without the prior written consent of J.P. Morgan. Any unauthorized use is strictly prohibited. Any product names, company names and logos mentioned or included herein are trademarks or registered trademarks of their respective owners.

Aumni, Inc. (“Aumni”) is a wholly-owned subsidiary of JPMorgan Chase & Co. Access to the Aumni platform is subject to execution of an applicable platform agreement and order form and access will be granted by J.P. Morgan in its sole discretion. J.P. Morgan is the global brand name for JPMorgan Chase & Co. and its subsidiaries and affiliates worldwide. Aumni does not provide any accounting, regulatory, tax, insurance, investment, or legal advice. The recipient of any information provided by Aumni must make an independent assessment of any legal, credit, tax, insurance, regulatory and accounting issues with its own professional advisors in the context of its particular circumstances. Aumni is neither a broker-dealer nor a member of any exchanges or self-regulatory organizations.

383 Madison Ave, New York, NY 10017

.avif)